Finance & Insurance

At Moto1 Motorcycles we want to make sure you can just get out and enjoy your dream bike like you deserve. That includes helping you with all your motorcycle finance and insurance needs.

We have fully accredited staff dedicated to giving you the best motorcycle finance advice and putting together a motorcycle loan package that suits you and your lifestyle at a very competitive rate.

Whether that’s a new or used motorcycle and even some of the extras you might need like motorcycle accessories, safety gear, motorcycle insurance or motorcycle rider training. We offer motorcycle finance packages starting a a minimum spend of $1500. This allows you the flexibility to use your cash in other ways in the meantime.

Motorcycle Finance and Insurance go hand in hand. We can get you insurance coverage to protect you and your dream bike with Comprehensive Motorcycle Insurance, Fire and Theft, Loan Protection Cover or Gap Cover. We can even re-quote your existing motorcycle insurance to make sure you are getting the best rate possible!

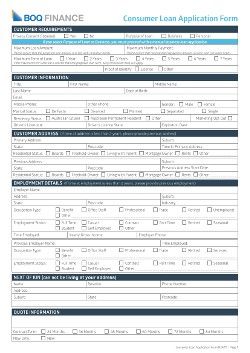

Simply fill out our Finance and Insurance Enquiry Form below with your details and we will call you for a no obligation free quote.

Finance and Insurance Enquiry Form

Application Form

FAQ’s

Yes of course, whether you are into a dirt bike or road bike we can offer finance terms for both registered or unregistered bikes as well as parts, accessories, insurance, riding gear and motorcycle rider training fees.

You can get prepared by making sure you have personal identification available like your drivers license, passport or Medicare card, your two most recent payslips, and a bank statement to prove your residential address.

Rates are based on the personal information and the history you provide, so your application needs to be assessed by our lenders. Our Business Managers have access to a wide range of lenders in our network to get the most competitive rates possible.